What is Talking Wealth?

Talking Wealth is more than just a catchphrase; it represents a comprehensive approach to understanding, managing, and growing your financial resources. At its core, Talking Wealth involves engaging in meaningful conversations about money, investments, savings, and overall financial health. By embracing this concept, you can pave the way for financial stability and independence.

Definition and Philosophy

Talking Wealth is the practice of continuously educating oneself about financial matters and making informed decisions to secure one’s financial future. This philosophy encourages open discussions about money, aiming to demystify financial concepts and make them accessible to everyone. It’s about breaking down the barriers that often surround financial conversations and empowering individuals to take control of their economic destiny.

Key Components of Talking Wealth

- Financial Literacy

- Understanding basic financial concepts such as budgeting, saving, investing, and debt management.

- Staying informed about changes in the financial landscape, including new investment opportunities and market trends.

- Wealth Mindset

- Developing a positive attitude towards money and wealth creation.

- Cultivating habits that promote financial growth, such as disciplined saving and prudent investing.

- Practical Strategies

- Implementing actionable steps to manage and grow your wealth, such as setting financial goals, creating budgets, and diversifying investments.

- Utilizing financial tools and resources to optimize your financial decisions.

Visualizing Talking Wealth

To better understand the concept of Talking Wealth, consider including the following images in your blog post:

- Financial Literacy: An infographic depicting key financial concepts and their importance.

- Wealth Mindset: A motivational quote or image emphasizing the power of a positive financial mindset.

- Practical Strategies: A step-by-step guide or flowchart showing actionable steps to improve financial health.

Why Talking Wealth Matters

Engaging in Talking Wealth is crucial because it empowers individuals to make informed financial decisions. By understanding and discussing financial matters, you can:

- Plan effectively for the future, including retirement and emergency funds.

- Reduce financial stress by having clear strategies in place.

- Increase your financial confidence and independence.

In conclusion, Talking Wealth is about fostering a proactive approach to financial management. By embracing financial literacy, cultivating a wealth mindset, and implementing practical strategies, you can achieve financial freedom and security.

Steps to Start Talking Wealth

Embarking on the journey of Talking Wealth involves taking actionable steps toward understanding and managing your finances effectively. Here are the key steps to get started:

Educate Yourself

- Read Books and Articles

- Begin with fundamental books on personal finance and wealth management. Titles like “Rich Dad Poor Dad” by Robert Kiyosaki and “The Total Money Makeover” by Dave Ramsey are great starting points.

- Regularly read financial articles and blogs to stay updated on the latest trends and advice. Image Suggestion: Display book covers or a person reading a finance book to visually emphasize the importance of self-education.

- Take Online Courses

- Platforms such as Coursera, Udemy, and Khan Academy offer excellent courses on personal finance, investing, and budgeting.

- These courses provide structured learning and can help deepen your understanding of complex financial concepts. Image Suggestion: Screenshot or logo of popular online learning platforms.

Create a Budget

- Track Your Spending

- Use budgeting apps like Mint, YNAB (You Need a Budget), or PocketGuard to monitor your spending habits.

- Categorize your expenses to identify areas where you can cut back and save more. Image Suggestion: A screenshot of a budgeting app interface or a chart showing expense categories.

- Set Financial Goals

- Define clear short-term and long-term financial goals. This could include saving for a vacation, buying a home, or building an emergency fund.

- Having specific goals helps in creating a focused budget and motivates you to stick to it. Image Suggestion: A checklist or goal-setting worksheet.

Invest Wisely

- Diversify Your Portfolio

- Spread your investments across different asset classes such as stocks, bonds, real estate, and mutual funds. Diversification helps mitigate risk.

- Regularly review and adjust your portfolio based on market conditions and your financial goals. Image Suggestion: A pie chart showing a diversified investment portfolio.

- Seek Professional Advice

- Consult with financial advisors to craft an investment strategy tailored to your needs and risk tolerance.

- Professional advice can help you navigate complex investment choices and market fluctuations. Image Suggestion: Image of a financial advisor discussing investment options with a client.

Build an Emergency Fund

- Save Regularly

- Aim to save at least 3-6 months’ worth of living expenses in an easily accessible account.

- Set up automatic transfers to your savings account to ensure consistent contributions.

- Choose High-Interest Savings Accounts

- Opt for savings accounts that offer high interest rates to maximize the growth of your emergency fund.

- Compare different accounts to find the best rates and terms. Image Suggestion: Comparison chart of different high-interest savings accounts.

Reduce Debt

- Pay Off High-Interest Debt First

- Prioritize paying off high-interest debts, such as credit card balances, to reduce the amount of interest you pay over time.

- Use methods like the debt avalanche or debt snowball to systematically eliminate your debt. Image Suggestion: A visual representation of the debt snowball or debt avalanche method.

- Consolidate Loans

- Consider consolidating your debts into a single loan with a lower interest rate. This can simplify your payments and reduce the total interest paid.

- Research and compare different consolidation options to find the best fit for your situation. Image Suggestion: Diagram showing how loan consolidation works.

Plan for Retirement

- Contribute to Retirement Accounts

- Make regular contributions to retirement accounts like 401(k), IRA, or Roth IRA. Take advantage of employer matches if available.

- Start early to benefit from the power of compound interest. Image Suggestion: Growth chart showing the benefits of early retirement savings.

- Understand Social Security Benefits

- Educate yourself on the benefits you are entitled to and how they fit into your retirement plan.

- Consider factors like the age at which you start taking benefits and how it impacts the monthly amount you receive. Image Suggestion: Chart showing Social Security benefit amounts based on the starting age.

In conclusion, taking these steps to start Talking Wealth will set you on the path to financial freedom. By educating yourself, creating a budget, investing wisely, building an emergency fund, reducing debt, and planning for retirement, you can achieve a secure and prosperous financial future.

Talking Wealth with Your Family

Talking Wealth with your family is essential for fostering a healthy financial environment at home. Open and honest conversations about money can help everyone understand the importance of financial management, set common goals, and work together to achieve financial stability and prosperity. Here are some practical steps to effectively engage in financial discussions with your family.

Importance of Financial Discussions within the Family

- Promotes Financial Literacy

- Teaching family members about financial concepts helps build their knowledge and confidence in managing money.

- It encourages responsible financial behaviors and decision-making. Image Suggestion: A family sitting around a table discussing finances, with charts and documents in front of them.

- Fosters Transparency and Trust

- Open discussions about money can prevent misunderstandings and build trust among family members.

- It ensures everyone is aware of the family’s financial situation and goals. Image Suggestion: A family holding a meeting, showing positive interaction and engagement.

- Helps in Setting and Achieving Common Goals

- Collaborative goal-setting aligns everyone’s efforts towards achieving shared financial objectives, such as saving for a vacation or paying off debt.

- It motivates family members to contribute and support each other in reaching these goals. Image Suggestion: A goal-setting worksheet or a family vision board with financial goals.

Tips for Scheduling Money Meetings

- Set a Regular Schedule

- Establish a regular time for family money meetings, such as monthly or quarterly. Consistency is key to staying on track.

- Ensure the chosen time is convenient for all family members to encourage full participation. Image Suggestion: A calendar marked with scheduled money meetings.

- Prepare an Agenda

- Create an agenda for each meeting to keep discussions focused and productive. Include topics like budget review, savings progress, and upcoming expenses.

- Distribute the agenda beforehand so everyone can prepare. Image Suggestion: An example of a meeting agenda template.

- Encourage Open Communication

- Foster an environment where everyone feels comfortable sharing their thoughts and concerns. Listen actively and address any questions or issues that arise.

- Encourage younger family members to participate and learn. Image Suggestion: Family members actively discussing and listening during a meeting.

Educating Children about Money

- Start Early

- Introduce basic financial concepts to children from a young age. Teach them the value of money, saving, and budgeting through practical examples and activities.

- Use age-appropriate tools, such as piggy banks for young children and savings accounts for teenagers. Image Suggestion: A parent teaching a child how to use a piggy bank or open a savings account.

- Use Allowance as a Teaching Tool

- Give children a regular allowance and encourage them to manage it wisely. Teach them to allocate money for saving, spending, and giving.

- Discuss the importance of setting financial goals and making thoughtful spending decisions. Image Suggestion: A chart showing a child’s allowance breakdown into saving, spending, and giving categories.

- Involve Them in Family Financial Decisions

- Include children in appropriate family financial decisions to help them understand the impact of these choices.

- Use real-life scenarios to explain concepts like budgeting for a family vacation or saving for a big purchase.

Setting Joint Financial Goals

- Define Clear Goals

- Collaboratively define clear, achievable financial goals that the whole family can work towards. Examples include paying off debt, saving for a home, or building an emergency fund.

- Ensure goals are specific, measurable, attainable, relevant, and time-bound (SMART). Image Suggestion: A SMART goals template or a family goal-setting worksheet.

- Create a Family Budget

- Develop a family budget that outlines income, expenses, and savings targets. Regularly review and adjust the budget to stay on track.

- Allocate funds towards joint goals and monitor progress together. Image Suggestion: A budget spreadsheet or a family budget planner.

- Celebrate Milestones

- Celebrate milestones and achievements as a family to maintain motivation and reinforce positive financial behaviors.

- Acknowledge each family member’s contributions and efforts. Image Suggestion: A family celebrating a financial milestone, such as a debt-free celebration or a savings goal achievement.

In conclusion, Talking Wealth with your family is a vital step towards building a financially secure and prosperous future together. By promoting financial literacy, fostering transparency, setting common goals, and educating children about money, you can create a supportive environment where everyone is empowered to make sound financial decisions.

FAQs about Talking Wealth

Talking Wealth can be a complex topic, and it’s natural to have questions. Here are some frequently asked questions about Talking Wealth, along with clear and concise answers to help you navigate your financial journey.

What is Talking Wealth?

Talking Wealth is the practice of engaging in meaningful conversations about finances, including saving, investing, budgeting, and overall financial health. It aims to increase financial literacy and empower individuals to take control of their financial future.

Image Suggestion: An illustration of people having a discussion with financial charts and graphs in the background.

Why is financial literacy important in Talking Wealth?

Financial literacy is crucial because it equips you with the knowledge to make informed financial decisions. Understanding concepts like interest rates, investment options, and budgeting helps you manage your money effectively and avoid common financial pitfalls.

How do I start budgeting?

Start by tracking your income and expenses for a month. Use budgeting apps like Mint or YNAB to categorize your spending and identify areas where you can cut back. Set financial goals and allocate your income accordingly to ensure you save and invest wisely.

Image Suggestion: A screenshot of a budgeting app interface.

What are some effective strategies for reducing debt?

Focus on paying off high-interest debt first, such as credit card balances. Use methods like the debt avalanche (paying off highest interest debts first) or the debt snowball (paying off smallest debts first) to stay motivated. Consider consolidating debts to secure a lower interest rate and simplify payments.

Image Suggestion: A visual representation of the debt snowball method.

How can I start investing?

Begin by educating yourself about different investment options such as stocks, bonds, and mutual funds. Diversify your investments to spread risk. Start with small amounts and gradually increase as you become more comfortable. Seeking advice from a financial advisor can also help tailor an investment strategy to your needs.

Image Suggestion: A pie chart illustrating a diversified investment portfolio.

What is an emergency fund, and why do I need one?

An emergency fund is a savings account specifically set aside for unexpected expenses like medical emergencies or job loss. It provides a financial cushion that helps you avoid debt during tough times. Aim to save 3-6 months’ worth of living expenses in a high-interest savings account.

Image Suggestion: An image of a piggy bank labeled “Emergency Fund.”

How do I plan for retirement?

Start by contributing regularly to retirement accounts like a 401(k), IRA, or Roth IRA. Take advantage of employer matching contributions if available. Educate yourself about Social Security benefits and how they fit into your retirement plan. The earlier you start, the more you benefit from compound interest.

Image Suggestion: A growth chart showing the benefits of starting retirement savings early.

What tools and resources are available for Talking Wealth?

There are numerous tools and resources available, including:

- Budgeting apps: Mint, YNAB

- Investment platforms: Robinhood, E*TRADE

- Educational courses: Coursera, Udemy

- Financial blogs and podcasts

Image Suggestion: Logos or screenshots of popular financial tools and resources.

Can Talking Wealth help reduce financial stress?

Yes, Talking Wealth can significantly reduce financial stress by providing clear strategies for managing money, setting goals, and preparing for the future. Being financially informed and proactive helps you feel more in control of your finances, reducing anxiety and uncertainty.

Image Suggestion: A relaxed person looking at a well-organized financial plan.

How can I encourage my family to start Talking Wealth?

Initiate regular financial discussions with your family. Share what you’ve learned and set joint financial goals. Educate your children about money management from a young age to build their financial literacy. Open communication and shared goals can foster a supportive environment for financial growth.

Image Suggestion: A family having a discussion at a table with financial documents.

Conclusion

Understanding and implementing the principles of Talking Wealth can transform your financial health. By addressing these frequently asked questions, you can gain a clearer picture of how to manage your money effectively and build a secure financial future.

Conclusion

What if you could gain the knowledge and confidence to change your circumstances for the better for you and your loved ones?

- The confidence to feel in control, so you get more out of life

- The confidence to make more informed decisions, so you create a better life

- The confidence to master your (overall) financial, personal and mental wellbeing

Then, join the movement with Talking Wealth and discover what’s possible.

Living your best life doesn’t have to cost a fortune

Did you know that your financial wellbeing is a critical component of your overall wellbeing?

But alarmingly, more than 70% of individuals don’t seek out professional advice because:

- It is perceived as too expensive or they don’t believe they can afford it

- They don’t trust professional financial advisers

- They don’t believe their circumstances justify the need

- They don’t see the value in financial advice, or

- They prefer to manage their own finances.

While we all worry about money for the majority this can lead to physical and mental health issues, as it causes overwhelming stress and anxiety not to mention confusion and regret.

But you can change your circumstances for the better.

Be empowered for less than the cost of a cup of coffee a week

If you watch Netflix regularly, I have a question for you…does it move you toward or away from what you want to accomplish? The compounding effect is defined as the principle of reaping huge rewards from a series of small, smart choices. That’s right…small changes overtime can compound into dramatic results.

Yet what does getting addicted to Netflix or social media actually do for you? The binge watching and endless scrolling is the equivalent of eating junk food every night.

Remember, the saying ‘you are what you eat’ also applies to what you feed your mind – and let’s face it…these habits destroy your focus, numb you into submission and take away your most valuable resource: TIME

Yet simplistic advice like ‘stop doing it’ probably won’t change anything. Instead, you need to replace that bad habit with a positive one that yields the same rewards as the unhealthy habit.

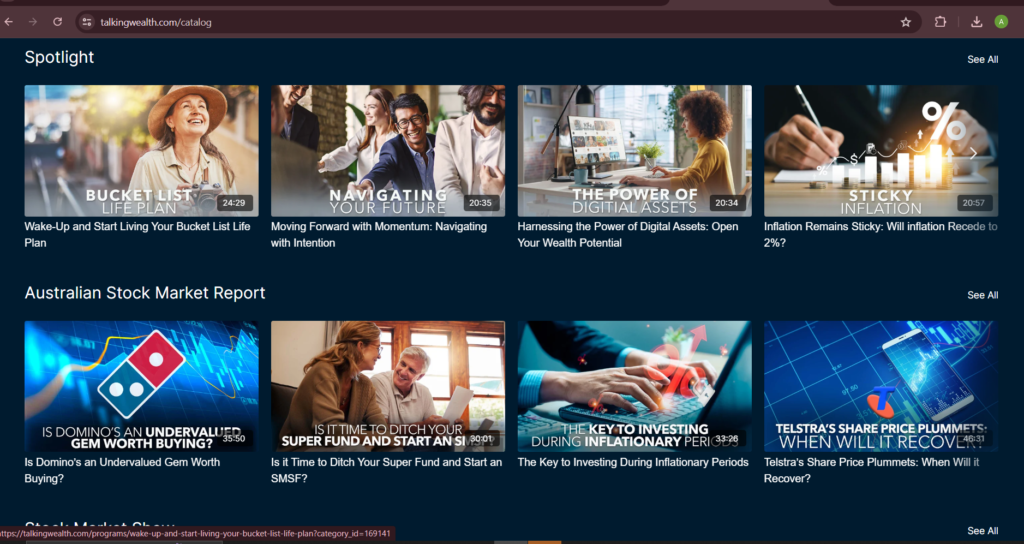

That’s why we created Talking Wealth, a streaming service that replaces ‘junk food’ TV and social scrolling with expert knowledge and inspiring content across a variety of genres.

That’s right, for less than the cost of a cup of coffee a week, you can access hundreds of curated videos from world leading experts who are passionate about empowering you to lead a wealthier, healthier and more secure life. And you can watch them anywhere, anytime on any internet-connected device, whether it be your smart TV, smartphone, tablet or personal computer.

Why Talking Wealth?

Because you’ll be empowered to make more educated and informed decisions, so you enjoy a sense of total wellbeing across all areas of your life including:

- Financial Wellbeing

- Managing Your Mindset

- Wealth Management

- Psychology of Money

- How to Start Investing

- Family Wealth

- Kids and Investing

- Health and Nutrition

- Investing in Property

- Business and Entrepreneurship

- Sales and Marketing

- And much more…

Acquire the Knowledge. Create the Wealth.®

If you’re looking for credible answers to your most burning questions or you just want to find relevant and reliable information you can trust, join Talking Wealth TV and start leading a wealthier, healthier and happier life on your terms.

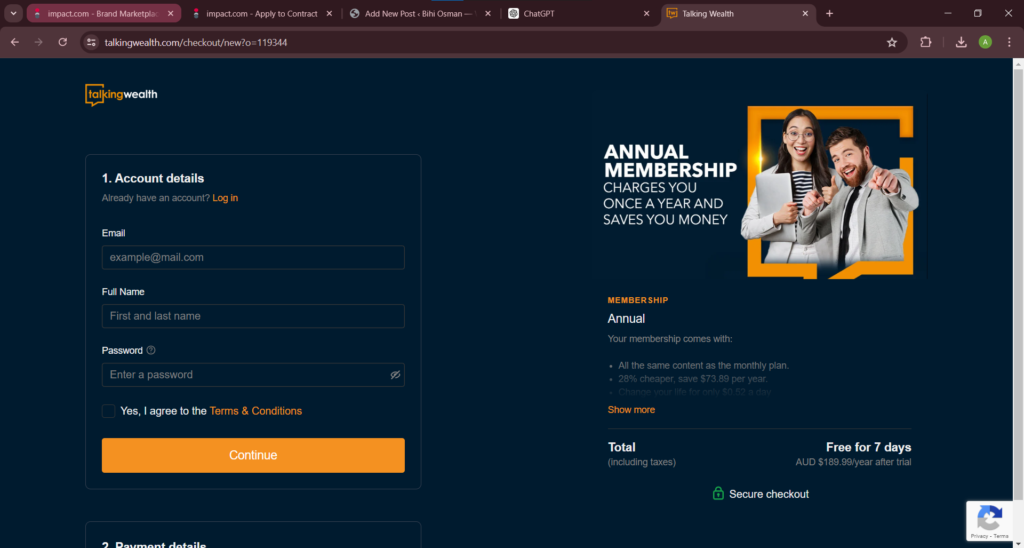

Getting started is easy and there’s a plan to suit everyone. Choose the plan that best fits your needs, so you can live your best life.

Owww on that